If the timeline of the EV future were measured by our distance from a black hole, we would be right at the event horizon. That is the part of the black hole where it is impossible to escape and collision is inevitable. It isn’t all doom and gloom, however, because there is plenty to be excited about when it comes to new electrified hardware. Electric motorcycles are particularly interesting new things to keep an eye on, specifically Harley-Davidson’s subdivision LiveWire.

With the space heating up rapidly, the financial sector is taking notice of the growth and potential of EV offerings, including electric motorcycles. The earliest of the electric car companies was Tesla, now Rivian and Lucid are the most recent serious competitors, at least in terms of investment. Now, LiveWire is going to join the party on Wall Street by going public via a different method that is not a traditional initial public offering (IPO).

Let’s take a look at how that is possible and what it means for the burgeoning electric motorcycle market.

Welcome to Headlight. This is a daily news feature that lights up one current event in the car world and breaks it down by three simple subheadings: What Happened, Why It Matters, and What To Look For Next. Look for it in the morning (Eastern time) every weekday.

What Happened

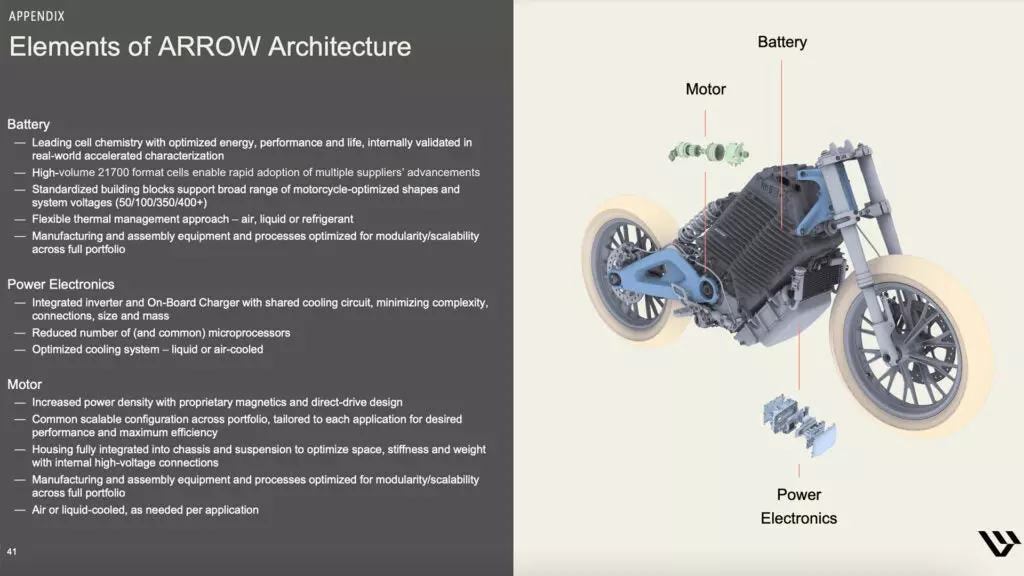

LiveWire, the electric division of Harley-Davidson motorcycles, is going public by merging with a special acquisition company, known as a SPAC. Merging with AEA-Bridges Impact Corp. (ABIC), formed by private equity executives Michele Giddens and John Garcia, and KYMCO, a Taiwanese scooter maker. LiveWire will have $600 million invested in the merger deal to bring it public on the New York Stock Exchange.

ABIC will finance $400 million of the deal, while Harley-Davidson and KYMCO will add $100 million each. KYMCO will also act as a strategic partner to LiveWire that will shoulder some production and distribution capacity in upcoming product lines and market expansions. Currently, Livewire sells bikes in North America and Europe, and intends to expand into additional markets like Asia in the short term.

Through this deal with a SPAC, which is considered a “blank check” company, LiveWire can expedite its IPO and generate public interest and investment in the short term. IPOs normally take a long time thanks to a lengthy vetting process that is highly regulated. Companies seeking an IPO can take at least a year to clear the process after its finances and assets have been scrutinized by the Securities and Exchange Commission (SEC) and banks. Through a SPAC, which has no real assets and a lot of capital, this process is expedited. The SPAC is sent to IPO, then another company can merge and essentially skip the IPO process. Lucid went public on a similar, albeit larger, deal.

This deal will make LiveWire the first publicly traded electric motorcycle company in the United States, part of a larger plan by Harley-Davidson called “The Hardwire.” Sales of the storied motorcycle brand’s product have struggled in recent years and this aggressive plan surely hopes to reinvigorate the company and make it relevant once more.

Why It Matters

On its own, taking an electric motorcycle company public is a major step for what used to be a funny little industry of oddball bikes that didn’t really work well in any situation. Electric bikes have come an astoundingly long way in just a few years, in part thanks to the rapidly accelerating development of electric cars. More technologies than ever are at the disposal of anyone looking to make an EV.

The most recent electric bikes are truly remarkable. They are approaching conventional gasoline-powered bikes in terms of range and outright power output, all while being quieter and more comfortable. Weight is still an issue, though many road bikes are on the heavy side. They present a new way to feel the freedom of a bike, especially in tasks that involve off-road exploration or urban assault.

Ignoring the financial stuff that I barely understand for a moment, I’ve ridden dirt bikes for a good few years now and I do love the gruff clanging and banging of a single-cylinder thumper beneath my saddle, but after riding an electric motorcycle (a Zero FX) off-road, I’ve come to realize that it isn’t the entire experience. You still feel the oneness with the bike, the swift and freeing motions of steering and leaning, and there is still plenty of power at the twist of a wrist. Bikes may have the coolest engines of any motorized vehicle (debate me), but the forced cohesion of riding is the same no matter how the bike is powered.

I’d go so far as to argue that the electric bike is the best way to ride. I will absolutely miss the action of shifting a bike, and certainly spinning a small-displacement engine to the moon, but there are other benefits to the electric stuff. Instead of scaring every bit of wildlife away on a mountain ride or a trail ride, you can hear yourself breathe, hear the crunch of gravel giving way beneath the tires, and become closer to nature. Isn’t that one of the foundational elements that riders love?

The truth is that motorcycles do have emissions regulations, but they are not as strict as those put on cars. This will almost certainly not last forever, and it will be much easier to kill internal combustion motorcycles than cars. It’s good for everyone if electric bikes become a real thing, and they won’t be any less fun. In many ways, they’re a lot better. In other ways, much worse.

So, seeing LiveWire enter a larger market, seeking more money to make more electric bikes, is something to keep an eye on. Moves like these pseudo-IPOs are more about making money than actual public good, but if everything goes well, we could have more electric bikes to try out. Count me in as excited.

What To Look For Next

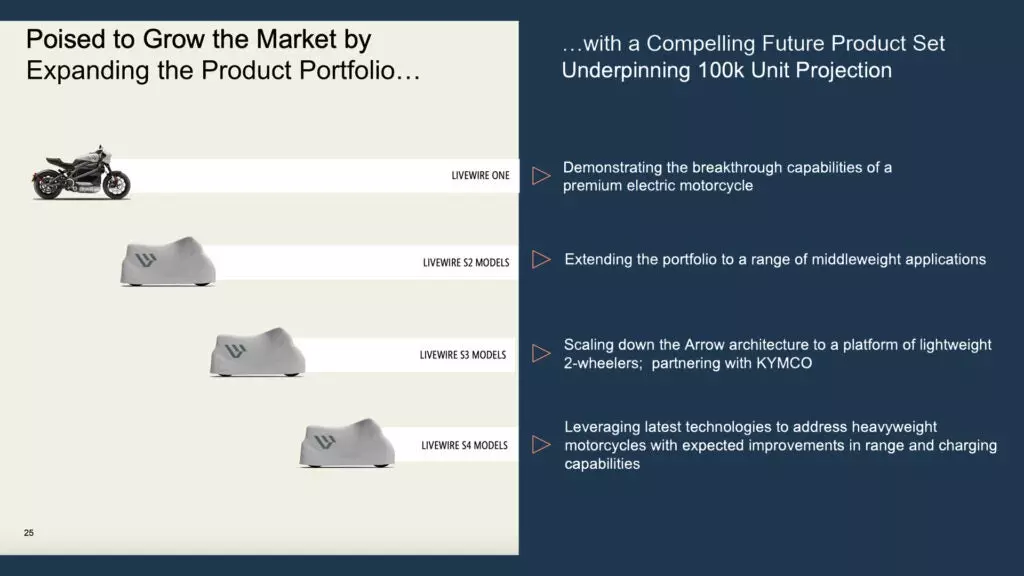

Once the LiveWire SPAC deal closes, they will be listed on the NYSE under the stock ticker “LVW.” Plans to expand the LiveWire product lineup are also due to start bearing fruit soon, with new models coming in 2022.

The deal is due to close in the first half of 2022, where it will be listed for public trade. Until then, LiveWire will operate as normal.

What to read next:

- Watch Peter Nelson participate in Land Rover’s Trophy Competition driving all-new Defenders in the mountains of Asheville, North Carolina.

- Why drift fans are mourning Japan’s Ebisu Minami drift circuit.

- It’s a major deal that iRacing put a factory-supported Mercedes F1 car into its simulator, and Chris Rosales tested it out.

- If you weren’t able to check out Autopia 2099, we attended the EV car show and took a bunch of photos.

- Find out why downgrading from coilovers back to conventional suspension can be the right move for the right situation.